Whose House is This, Anyway?

When buying a house, you need to determine who the legal owners of the house will be, who is going to be on the mortgage loan, and how the title will be held. Some spouses prefer not to be in title on their home, leaving the other spouse as the sole owner. This is sometimes done to limit potential liabilities of one of the spouses and protect the property from potential liens. Even if a spouse is not in title, they still have some property rights in most states. These are sometimes referred to as “homestead rights” or “dower rights.1”At least one person in title must also be an applicant on the mortgage loan.Sometimes real properties are held in trust. A trust is a relationship where a person or company (the trustee) is under a legal obligation to deal with property owned by the trust (trust property) for the benefit of some other person or persons (beneficiaries) or for some specific purpose. People often place real property in trust to limit liability, avoid potential liens, or to purchase a home anonymously.

Bridge Loans

If you have significant equity in your current home that you’d like to use for the down payment on a new home, consider a bridge loan. Bridge loans are commonly used to buy a new home before selling an existing home. And once you do sell your current home, you can use the proceeds to pay off the bridge loan.PMI Insurance

While lenders will make loans with a loan to value (LTV) as high as 95%, to offset risk, they often require private mortgage insurance (PMI) for any loans above 80% loan to value (LTV). PMI typically costs $40 to $80 per month.LTV Based Rates

In addition to PMI, many lenders charge higher interest rates for loans with higher LTVs. Not Third Federal. We offer one rate. If you qualify, you get it — period.

Credit Score and Credit Report

Mortgage lenders evaluate your credit score and credit report to determine your credit worthiness. Many lenders then offer higher rates to borrowers with lower credit scores. Not Third Federal. We have one rate. If you qualify for a loan, that’s the rate you get.

Property Types

Most mortgage lenders consider different types of property to represent different degrees of risk, and vary their product offerings accordingly. Common property types include:Single-family residence (not attached to other property)

Condominium

Town house

Plan Unit Development (PUD)

Loan Amounts

Many lenders charge higher rates for higher loan amounts in order to hedge themselves against greater risk. That won’t happen at Third Federal. We offer the same rate, no matter how much you borrow. (Because you should never pay more for bulk.)| Loan Amount Category | Loan Amount | Availability/Conditions |

| Conforming | $10,000 to $806,500 | Wide availability, few limitations or added conditions |

| Jumbo | $806,501 to $2,000,000 | Frequently available only at lower LTVs and usually requires additional rate premium. |

Closing Costs:

Closing costs are the costs paid by a buyer, or seller, or both, in order to purchase, sell or transfer real property. These closing costs are usually broken out into the categories below. |

Lender Fees: Lender fees are what you’re charged by your mortgage company to process your loan and cover originating costs. Lender fees can vary widely depending on the lender and/or type of loan. |

|

|

Third Party Fees: Third party fees are the cost of services performed by vendors, which include appraisals, credit reports, flood zone determination and tax service to make sure all the taxes on the sale property are up to date. These fees are pretty much the same, regardless of the lender or loan type. |

|

|

Settlement and Title Fees: Settlement and title fees pay for services that insure the title of the home you’re buying is free from claims and/or liens. These fees include charges for your survey, title exam, settlement agent, title insurance binder, tax search, closing protection, escrow fees, and (if required) title insurance. |

Escrow Deposits:

An escrow account holds funds that will be used to pay your real estate taxes and home owner's insurance. If your down payment is less than 30% of the purchase price, you’ll probably be required to set up an escrow account. You can also choose to set up an escrow account voluntarily. Escrow funds must be deposited by the time you close your loan.Prepaid Interest:

Prepaid interest refers to a payment that covers the interest on your loan from the date of funding to the end of the current month. Prepaid interest is due at closing.| Closing Date | Prepaid Interest | First Monthly Payment |

| March 15 | Covers March 15 through March 31 | Due May 1st (covers interest for April) |

Mortgage Types:

Which Loan is Right for You?

Adjustable Rate Mortgages

These allow you to combine a 15 or 30 year loan term with a shorter rate commitment. This allows you to amortize or calculate your payment over 15 or 30 years, keeping your monthly payment low but receive an interest rate commitment that's more appropriate for your situation. Adjustable rate mortgages are typically one to seven years of commitment, referred to as the initial rate period. After this period, adjustable rate mortgages reset annually Prime Rate minus 1.00%, presently 7.75%. The chart below outlines the most common adjustable rate mortgages.| Loan Type | Loan Term (total duration of mortgage) | Initial Rate Lock | Rate Adjustment Period |

| 1/1 Adjustable Rate Mortgage | 30 years | Rate fixed for the first year. | After that rate adjusts to Prime Rate presently 7.50% minus 1.00%. |

| 3/1 Adjustable Rate Mortgage | 30 years | Rate fixed for first three years. | After that rate adjusts to Prime Rate presently 7.50% minus 1.00%. |

| 5/1 Adjustable Rate Mortgage | 30 years | Rate fixed for first five years. | After that rate adjusts to Prime Rate presently 7.50% minus 1.00%. |

| 7/1 Adjustable Rate Mortgage | 30 years | Rate fixed for first seven years. | After that rate adjusts to Prime Rate presently 7.50% minus 1.00%. |

Building a New Home

There are three types of loans commonly used to build a home.

1. Construction Loan:

Construction loans cover the home building time frame and are given to a customer who owns the lot and has signed a contract with a builder. You’re charged for interest on the amount that has been paid from the loan to your builder – this includes any loan funds that have been disbursed to pay closing costs, or to purchase or pay off a mortgage on your lot. Your construction loan will end when your home is complete and you will need to get permanent financing, which sometimes requires you to pay closing costs again.2. Construction/Permanent Loan:

With a Construction/Permanent Loan the customer also typically owns the lot and the property during the construction phase. This loan offers a single loan for both the construction period and an ongoing mortgage once your home is completed. This type of loan automatically converts to a Permanent Loan without additional costs at the completion of the construction phase. The Construction/Permanent Loan can be either a fixed or adjustable rate of interest with basically the same terms and conditions as a Permanent Loan. It allows you and your builder up to twelve months to complete your home. During this construction period you will only be charged for interest on the amount that has been disbursed from the loan to your builder. Just like a construction loan, you will be billed for interest on a monthly basis. After your home is completed your loan will convert automatically to amortizing status and you will be responsible for payments of principal and interest on the funds the lender has loaned to you. There is no additional cost to convert your loan to a permanent loan status.3. End Loan:

End loans are a form of permanent financing for people who are building a new home with a builder who will maintain ownership of the property until construction is complete. An end loan enables you to secure a loan and interest rate on your new home while it is being built. You make no payments for principal or interest until the title transfers to you.

Tax Deductibility

Interest on mortgages can be tax-deductible2, making these lending products very efficient forms of borrowing. Because of the tax-deductibility, the effective interest rate (or real cost to you) on these products is much lower than the actual rate charged by the lender.| Mortgage Interest Rate (rate charged by lender) | Marginal Tax Rate (your highest tax bracket) | Effective Interest Rate (net of tax deductibility) |

| 4.00% | 28% | (1-.28) x 4.00% = 2.88% |

Discount Points

Points are simply an optional method to buy down your interest rate. The cost of a point is equal to 1 percent of the loan amount that is due at closing. In exchange for paying this fee, your interest rate is reduced. Points are frequently tax-deductible and make most sense when you plan to stay in your home, or your loan, for at least 5 years.Interest Rates, APRs, and Fully Indexed Rates

The interest rate is the actual rate that you pay and is used to determine your monthly payment. A lower interest rate means a lower monthly payment and lower interest expense.The Annual Percentage Rate is a second rate that includes the effect of upfront closing costs, such as processing, appraisal, credit report, underwriting, loan origination fees and mortgage insurance premiums. Some costs are not included in APRs and different lenders calculate APR differently. APR also assumes that you will have the loan for the entire term, but most people sell or refinance before the loan matures. Consequently, the APR is not always the most accurate way to assess the total cost or all in cost of your mortgage or the best way to compare mortgages.

The fully indexed rate pertains to adjustable rate mortgages and estimates the future interest rate that a borrower will be charged after their adjustable mortgage resets. It’s calculated by adding a rate index, which is usually a commonly published benchmark for rates, such as the London Interbank Offered Rate (LIBOR) or the US Prime Rate. This index is added to a predetermined margin set by the lender and agreed upon in your loan note signed at closing. For example, Third Federal’s index is the US Prime Rate minus 1.00%. So Third Federal’s fully indexed rate is Prime minus 1.00%, presently 7.50%. While the fully indexed rate may be the best approximation of the future interest rate at the time your adjustable rate mortgage is originated, interest rates fluctuate over time and your actual rate may be different then the fully indexed rate when it resets.

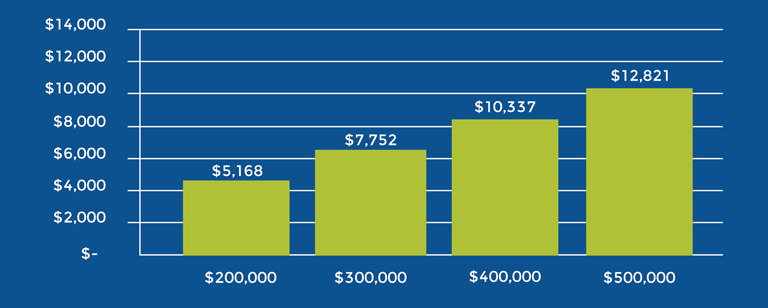

What’s the value of receiving a lower interest rate? If you find a lower rate—even just 1/4% or a 1/8% lower—you can save thousands of dollars over the life of your loan. The chart below shows the total cost of paying 1/8% higher rate over the life of your loan at various loan amounts3. Paying just 1/4% higher rate would be approximately double the cost.

Servicing Your Loan

It's a common practice in the mortgage industry for loans to be transferred or sold from one servicer to another. When this happens, your monthly payments are collected and processed by the new servicer and any questions or issues you have with your loan will also be handled by the new servicer. This can sometimes be problematic, especially when you are selling your house or refinancing your mortgage. When shopping for a loan, you may want to select a lender that services it's own loans.

Total Cost of Paying 1/8% Higher Rate

at Varying Loan Amounts

at Varying Loan Amounts

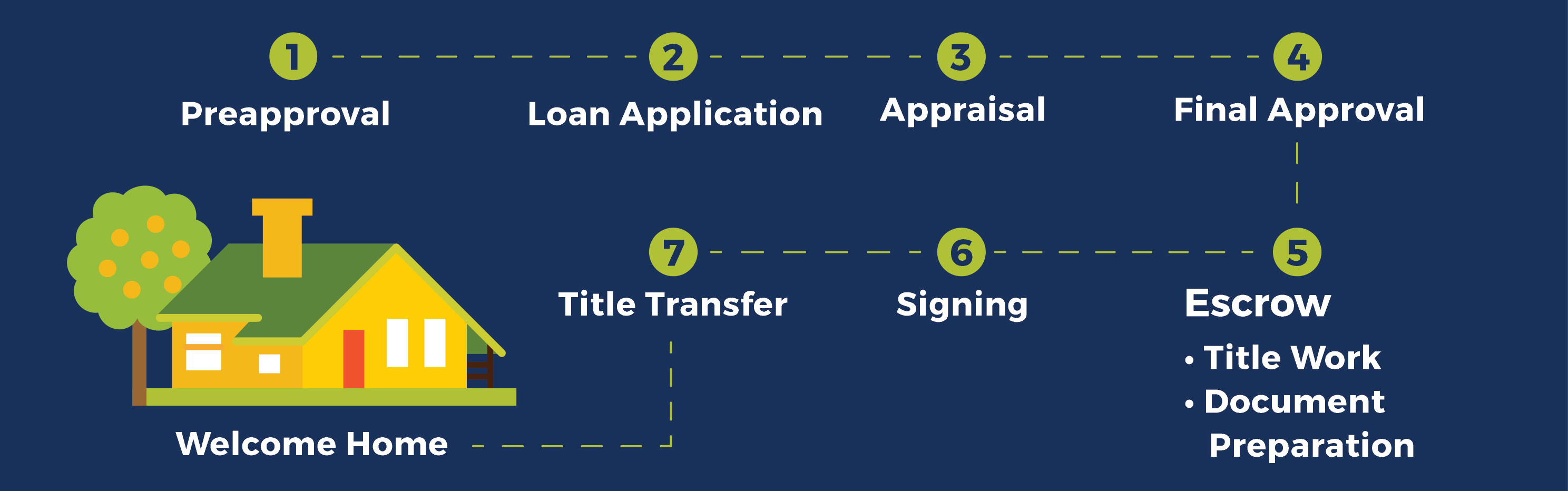

The Loan Process

Preapproval

We recommend that every buyer get preapproved even before shopping for a home. A preapproval lets you know the mortgage amount you qualify for and can be a great negotiating tool when you find the perfect home.Loan Application

When you find a home, you and the seller will negotiate terms for the sale of the house. Items generally negotiated will be: purchase price, closing date and date of possession. These terms will be stated in a purchase agreement and signed by both parties. Once you have a signed purchase agreement, present it to your loan counselor. Your counselor will help you select the mortgage that best meets your needs. You will then complete a loan application.You can apply for a loan in person, over the phone, or online. When you apply, you’ll need to provide income and asset documentation and verify your outstanding debts, and your lender will need to pull and review your credit. The process takes about 20 to 30 minutes. Most of the time when you apply for a mortgage you will receive an interest rate commitment (rate lock) at the time of application. This will protect you from a potential rate increase between the time you apply and the time your loan closes