Third Federal Savings & Loan

Ohio Priority 1 - NEO - Personalization

Third Federal.

Strong. Stable. Safe. A bank you can believe in.

All Mortgage Rates 0 Points

| Product | Rate | APR |

|---|---|---|

| 30 Year Fixed Rate | 5.790% | 5.813% |

| 30 Year Fixed Rate | 5.690% | 5.800% |

| 30 Year Fixed Rate | 5.690% | 5.745% |

| 30 Year Fixed Rate | 5.825% | 5.839% |

| 30 Year Low Cost Fixed Rate | 6.090% | 6.096% |

| 30 Year Low Cost Fixed Rate | 6.490% | 6.522% |

| 30 Year Low Cost Fixed Rate | 6.040% | 6.055% |

| 30 Year Low Cost Fixed Rate | 6.090% | 6.094% |

| 15 Year Fixed Rate | 5.290% | 5.329% |

| 15 Year Fixed Rate | 5.190% | 5.374% |

| 15 Year Fixed Rate | 5.190% | 5.281% |

| 15 Year Fixed Rate | 5.390% | 5.413% |

| 15 Year Low Cost Fixed Rate | 5.590% | 5.601% |

| 15 Year Low Cost Fixed Rate | 5.990% | 6.041% |

| 15 Year Low Cost Fixed Rate | 5.540% | 5.565% |

| 15 Year Low Cost Fixed Rate | 5.590% | 5.596% |

| 5/1 ARM (30 year) Low Cost | 5.890% | 6.415% |

| 5/1 ARM (30 year) Low Cost | 5.890% | 6.412% |

| 5/1 ARM (30 year) Low Cost | 5.940% | 6.444% |

| 5/1 ARM (30 year) Low Cost | 6.390% | 6.637% |

| Product | Rate | APR |

|---|---|---|

| 30 Year Fixed Rate | 5.990% | 6.035% |

| 30 Year Fixed Rate | 6.025% | 6.038% |

| 30 Year Low Cost Fixed Rate | 6.790% | 6.822% |

| 30 Year Low Cost Fixed Rate | 6.340% | 6.356% |

| 30 Year Low Cost Fixed Rate | 6.290% | 6.296% |

| 30 Year Low Cost Fixed Rate | 6.290% | 6.294% |

| 15 Year Fixed Rate | 5.390% | 5.463% |

| 15 Year Fixed Rate | 5.490% | 5.511% |

| 15 Year Low Cost Fixed Rate | 6.190% | 6.241% |

| 15 Year Low Cost Fixed Rate | 5.740% | 5.765% |

| 15 Year Low Cost Fixed Rate | 5.690% | 5.700% |

| 15 Year Low Cost Fixed Rate | 5.690% | 5.696% |

| 10 Year Low Cost Fixed Rate | 6.140% | 6.213% |

| 10 Year Low Cost Fixed Rate | 5.690% | 5.705% |

| 5/1 ARM (30 year) | 5.640% | 6.356% |

| 5/1 ARM (30 year) | 5.640% | 6.325% |

| Product | Rate | APR |

|---|---|---|

| Home Equity Line of Credit | 6.240% | 6.240% |

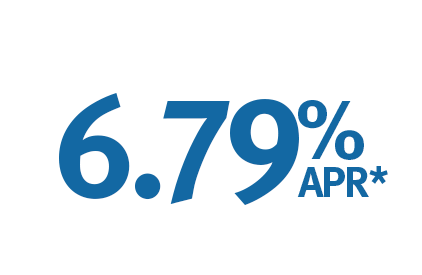

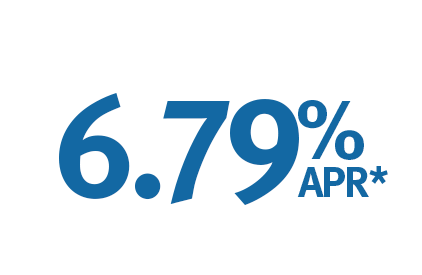

| 30 Year Home Equity Loan | 6.790% | 6.790% |

| 20 Year Home Equity Loan | 6.690% | 6.690% |

| 15 Year Home Equity Loan | 6.590% | 6.590% |

| 10 Year Home Equity Loan | 6.490% | 6.490% |

| 5/1 Home Equity Loan | 6.390% | 6.606% |

| Term | APY |

|---|---|

|

7 Day CD Minimum to Obtain: $500 |

2.65% |

|

3 Months Minimum to Obtain: $500 |

3.25% |

|

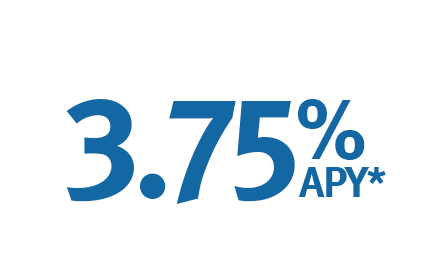

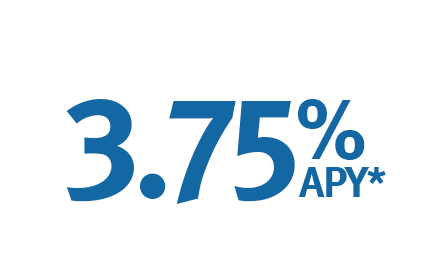

5 Month Special Minimum to Obtain: $500 |

3.75% |

|

29 Month Special Minimum to Obtain: $500 |

3.00% |

|

39 Month Special Minimum to Obtain: $500 |

3.00% |

|

49 Month Special Minimum to Obtain: $500 |

3.00% |

|

59 Month Special Minimum to Obtain: $500 |

3.00% |

Variable APR of Prime - .51%

-

Buy Now. Refi Later

If rates drop, even after you close on your loan, you can refinance to the lower rate for free.

-

5-Month Special CD

$500 minimum to open

Interest rates are expected to go down, so lock in a high rate today!

-

30-Year Equity Loan

Apply for a home equity loan for home improvements, college tuition or consolidate high-interest debt.